does north carolina charge sales tax on food

Grocery Food EXEMPT In the state of North Carolina any and. When calculating the sales tax for this purchase Steve applies the.

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

The State of North Carolina charges a sales tax rate of 475.

. General Sales and Use Tax Admission Charges Aircraft and Qualified Jet Engines Aviation Gasoline and Jet Fuel Boats Certain Digital Property Dry Cleaners Laundries Apparel and Linen. Does north carolina charge sales tax on food Monday September 19 2022 Edit. North Carolinas sales tax rates for commonly exempted items are as follows.

There is a sales tax exemption for food 45 in the State but local sales taxes article 39 40 and 42 are levied on food to generate a 2 sales tax on it. 53 rows While 32 states exempt groceries six additional states Arkansas Illinois Missouri Tennessee Utah and Virginia tax groceries at a lower preferential rate. Catering TAXABLE In the state of North Carolina any gratuities that are distributed to employees are not considered to be taxable.

The transit and other local rates do not apply to qualifying. North Carolina Fishing Licenses Laws And Regulations Fishing Org 10 Pros And Cons Of Living. Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a maximum.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Like most states there are goods exempt from the tax in North Carolina like food thats not prepackaged or served for consumption on site. The Mecklenburg County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Mecklenburg County local sales taxesThe local sales tax consists of.

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. This means that an individual in the state of North Carolina who sells school supplies and books would be required to charge sales tax but an individual who owns a store which sells groceries. Services in North Carolina are generally not taxable with important exceptions.

North Carolinas general state sales tax rate is 475 percent. A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones. But North Carolina does charge the.

If the service you provide includes creating or manufacturing a product you may have to deal. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

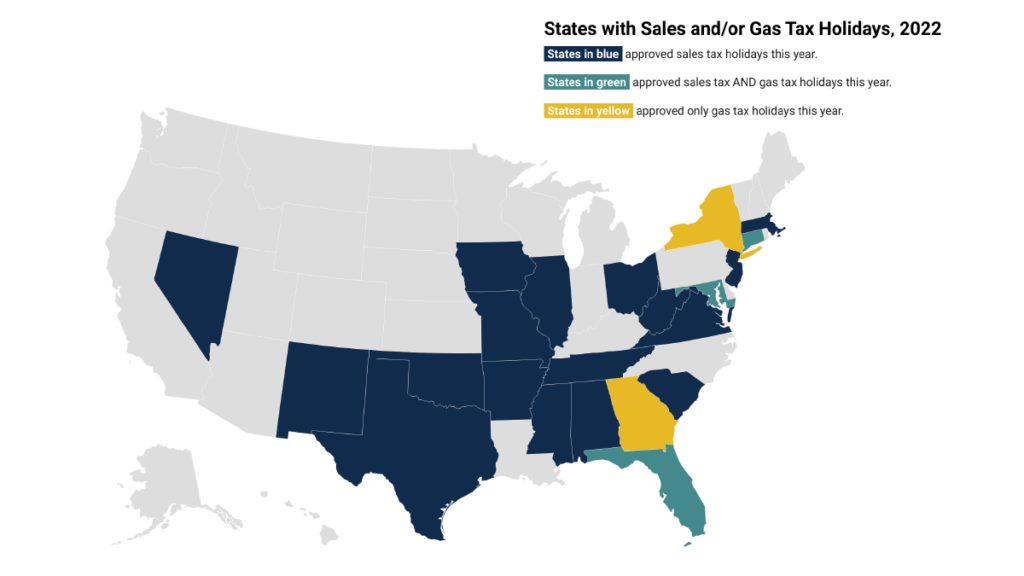

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Sales And Use Tax Regulations Article 3

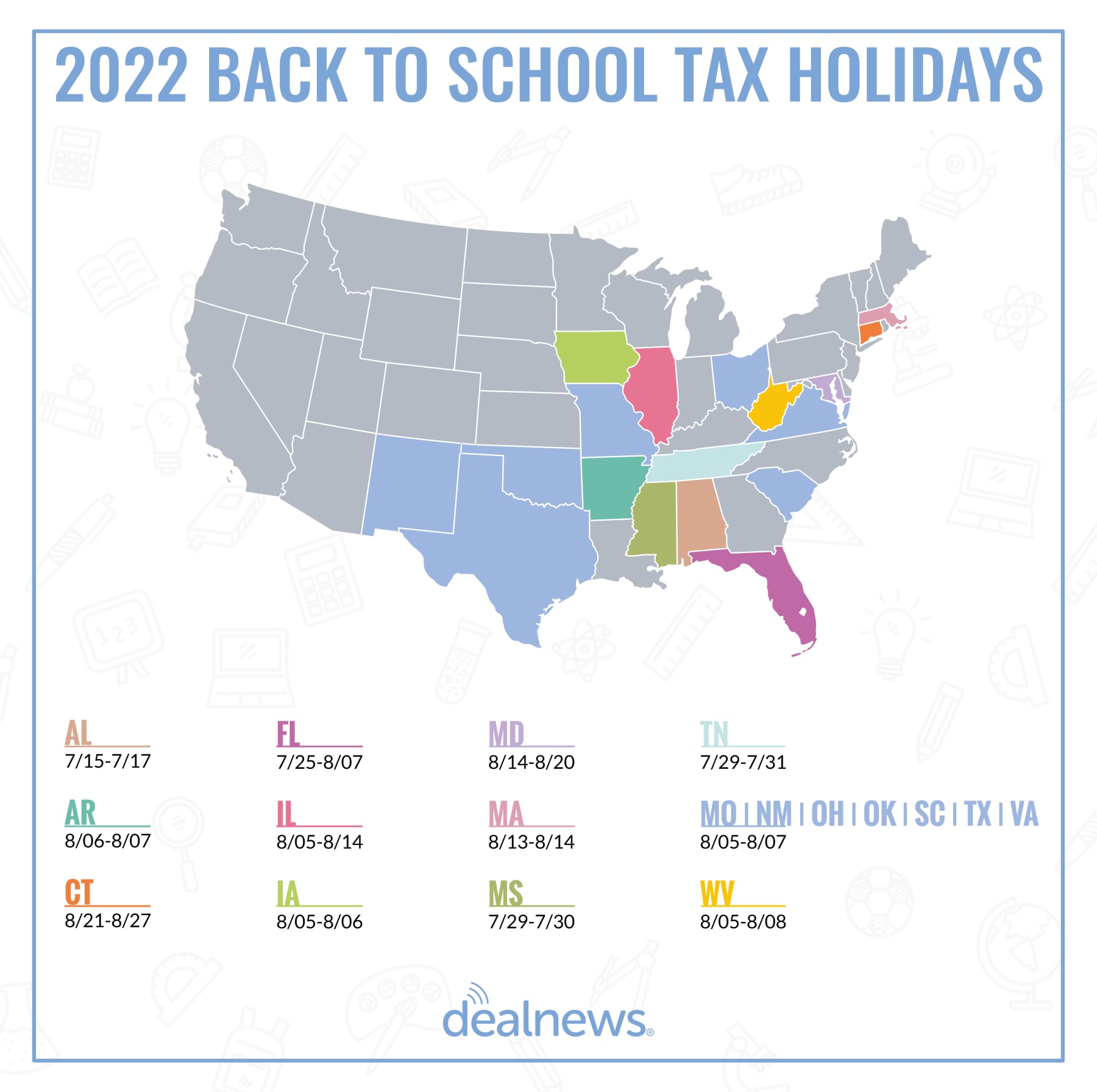

When Is Your State S Tax Free Weekend In 2022

New Budget Proposal Would End Sales Tax On Groceries For Oklahomans Ktul

Is Food Taxable In North Carolina Taxjar

Important Sales Tax Issue For Residents Chatham County Nc

General Sales Taxes And Gross Receipts Taxes Urban Institute

South Carolina Sales Tax Rate 2022

As Prices Rise The Push To End Diaper Taxes Grows The Pew Charitable Trusts

Sales Taxes In The United States Wikipedia

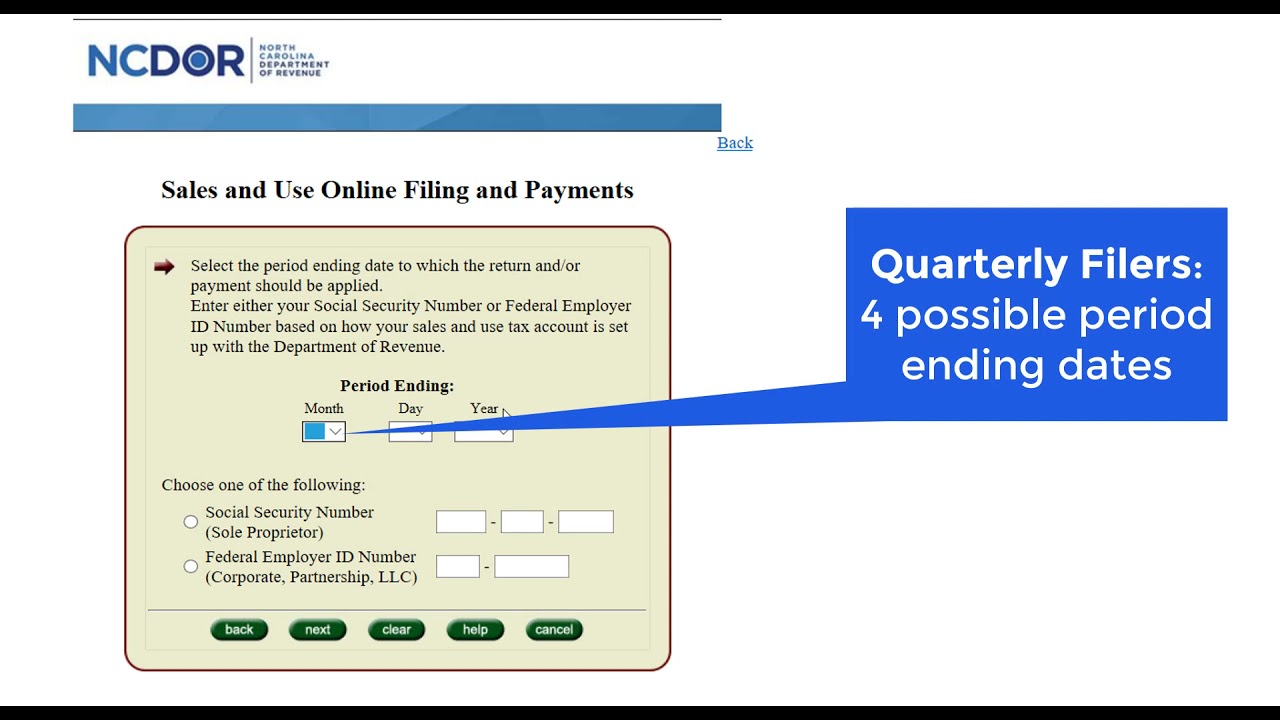

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

How To File And Pay Sales Tax In North Carolina Taxvalet

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Historical North Carolina Tax Policy Information Ballotpedia

Does Your State Still Tax Your Groceries Cheapism Com

How To Get A Sales Tax Certificate Of Exemption In North Carolina

North Carolina Government Plans To Collect Taxes On Food Ticket Sales At Universities Elon News Network

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com